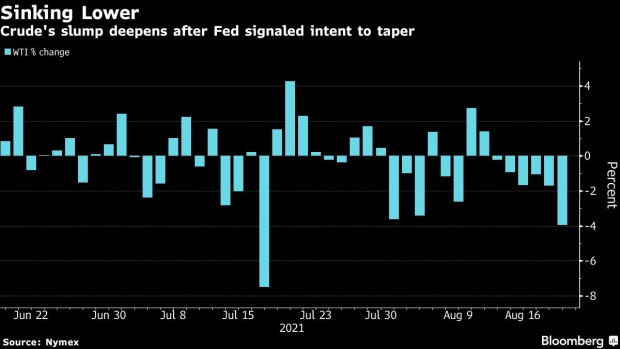

Oil fell for the sixth day in a row to the lowest level since May after the U.S. Federal Reserve on Wednesday signaled it was set to start tapering asset purchases within months.

West Texas Intermediate futures ended the session down 2.7 per cent, dipping below US$64 a barrel amid a broader commodity selloff as the prospect of reduced stimulus shook markets. The delta virus variant for air travel is denting demand, with enthusiasm for air travel waning in the both the U.S. and Japan. Asia’s physical market is softening with muted buying from China and a move by India to sell oil from its strategic reserves.

“The dollar is seeing considerable strength as the Fed moves to cool the economy,” said John Kilduff, a partner at Again Capital LLC. “Oil was already seeing downward pressure as the market reeled from softened demand coming out of China, and waning commodities appeal is encouraging the slump further.”

Oil’s rally in the first half of the year has lost momentum since July amid the threat to demand posed by the spread of the delta variant. At the same time, OPEC+ pushed ahead with gradually restoring supplies. The combination of factors has led leading analysts to lower price forecasts for the last half of the year.

To cushion the U.S. economy from the blow inflicted by the pandemic, the Fed has been buying US$120 billion of assets every month, buoying commodities. The minutes of the bank’s July meeting showed a potential pullback in its monthly bond purchases, as most participants now judged it could be appropriate to start reducing the pace of stimulus.

“Economic growth concerns, stronger dollar and a risk-off environment are not helping oil,” said Giovanni Staunovo, an analyst at UBS Group AG. “Demand will continue to recover in an uneven way over the coming weeks and the oil market remains under-supplied. So that should still support prices down the road.”

Prices:

- WTI for September delivery fell US$1.77 to settle at US$63.69 a barrel in New York. It slipped as much as 4.3 per cent earlier.

- Brent for October settlement declined US$1.78 to end session at US$66.45 a barrel.

Road traffic remains depressed in various Southeast Asian countries as various levels of lockdowns are still in place. “Indicators for consumption coming out of the region have global influence,” said Stewart Glickman, energy equity analyst at CFRA Research. “Where China goes, investors follow.”

Related coverage:

- Asia’s physical crude market softened this week as muted buying from China coincided with a surprise move by India to sell oil from its strategic reserves to state-run refiners.

- Barely a week after the White House called on OPEC+ to increase oil production faster, the group could be considering a very different route.

- Saudi Arabia is likely considering a pause in the next scheduled OPEC+ supply increase, according to Energy Aspects.

Oil posts longest losing streak in 18 months after Fed report - BNN

Read More

Tidak ada komentar:

Posting Komentar